A recurring theme of banking crises is who to apportion blame to.

Was the Global Financial crisis a result of deadbeat borrowers who would not repay their mortgages or was it the result of incompetent lenders who lent money to people who might not repay?

Was the Greek Financial Crisis a result of bad Greek politicians and lazy Greek people who would not repay their loans, or was it the result of incompetent German financial institutions that recklessly lent the money?

This dichotomy can lead to good feelings where there should be none. There is schadenfreude in feeling superior to the person who can’t repay their mortgages and is being kicked out of their house. Certainly it feels better on a personal level than accepting that you have failed by allocating capital badly.

It can be fun to blame other people.

But it is not productive. And it is not intellectually honest.

I allocate capital for a living. It is my firm view that mistakes of this nature are my own fault. Yes I may have invested in a fraud or in a company that was worthless (Sun Edison anyone) but the error is mine and I am responsible. I had to assess the risk. I had to read the documents or chose which documents to read. I had to make the decision.

The mistakes (and there are many) are mine.

The alternative of course is living in a fantasy land where all the successes (and there are many) are attributable to my genius and all the failures (alas many) are attributable to bad luck or the malfeasance of others.

You can accurately call that fantasy irresponsibility. Maybe reckless irresponsibility. And it will lead to permanent loss.

The issue of the day: Credit Suisse alternative Tier 1 capital notes

This leads me to the issue of the day - the Swiss financial regulator’s (FINMA’s) decision to simply cancel (“write-down”) about $17 billion in Credit Suisse Additional Tier 1 bonds (the so-called AT1s).

Now had I had a cursory look at the AT1s I would have thought that they were traditional bank preferred shares - that is they ranked ahead of common equity. I might have even traded them on that basis.

Fortunately I did not - because if I had I would have been wrong.

These were not ordinary preference shares ranking ahead of common equity. They were fixed income instruments that in times of stress ranked behind common equity.

Indeed I had never really ever considered the possibility of such an instrument - but that was only because I never read the documents.

The documents were not hard to find. They were on Credit Suisse’s website.

The document (which I have preserved here) makes it’s unusual nature right up-front. The Credit Suisse page linked above refers to these in bold letters as “Low-Trigger Capital Instruments”.

This does suggest a low trigger.

And boy is it a low trigger - the whole prospectus is dedicated to explaining how tough it is for these notes and their unusual character.

This is my favourite line:

Furthermore, any Write-down will be irrevocable and, upon the occurrence of a Write-down, Holders will not (i) receive any shares or other participation rights in CSG or be entitled to any other participation in the upside potential of any equity or debt securities issued by CSG or any other member of the Group, or (ii) be entitled to any write-up or any other compensation in the event of a potential recovery of CSG or any other member of the Group or any subsequent change in the CET1 Ratio, Higher Trigger Capital Ratio or financial condition thereof. The Write-down may occur even if existing preference shares, participation certificates and ordinary shares of CSG remain outstanding.

So there it is. And I have to repeat the prospectus: “The Write-down may occur even if … ordinary shares of CSG remain outstanding”.

Yep. It is there in plain English. You own these and you rank behind common stock!

Oh - and Credit Suisse did not hide it. You can find a fixed income presentation still on the website here:

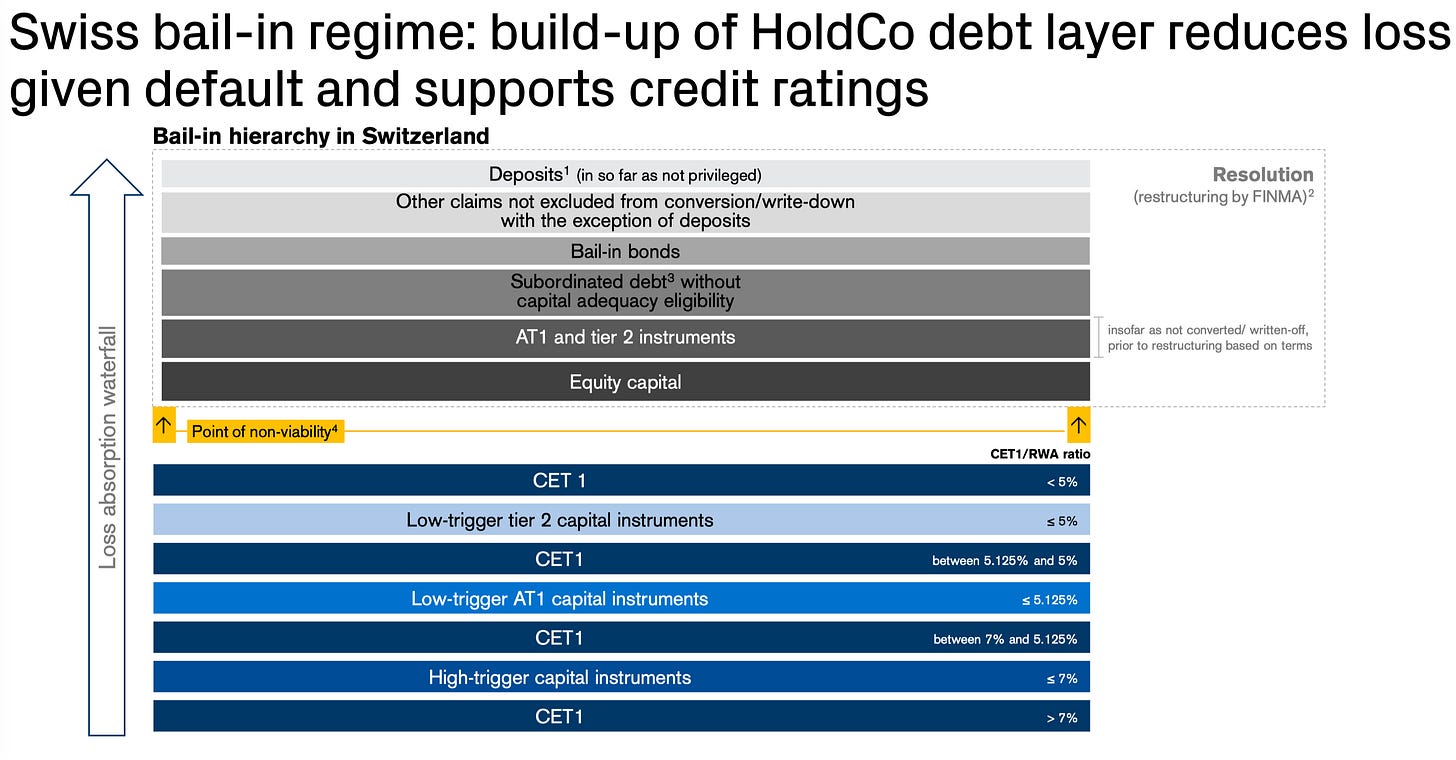

This fixed income presentation gives an order of creditors - with deposits being the most protected - and stuff at the bottom being the least protected.

It is absolutely clear. Low-trigger AT1s are further down the capital stack than equity capital. They clearly ranked below equity capital.

If you invested in AT1s thinking they were an ordinary preference share you were wrong. And you were wrong because you did not read the documents. The documents were readily available and spelled out the order of creditors in plain English.

So what is wrong with being wrong?

Being wrong is a problem. You lose money. That alas happens to all of us in this game. If I were at all interested in AT1s I would have been wrong - I would have thought they were senior to common equity even though the documents made clear that they were not.

Being wrong is normal.

What is not healthy for a fund manager is being wrong and blaming it on someone else.

If you think the Swiss Government stepped in to muck up the order of creditors and thus inflict losses on you then you are delusional.

The Swiss Government followed the order of creditors as disclosed both in the prospectus and in Credit Suisse presentations.

They did nothing wrong.

But you made a mistake. You did not read the documents. And most importantly you made a mistake for which you are responsible and you are not admitting it.

Fund managers blaming the Swiss Government

The press is full of angry fund managers saying that the Swiss Government has mucked around with the order of creditors (which is their excuse for losing money). They are predicting dire consequences for capital markets all over Europe as a result of reckless Swiss Government action.

This is all bullshit.

These fund managers made a mistake. They did not read the documents.

And they are not admitting their mistake.

They are blaming others - in this case the Swiss Government for their mistake.

It it not the mistake that bugs me - and it is not the mistake that should bug you. It is the denial, the blaming of others.

So I have a piece of advice for you. If you are a client of a fund manager that is blaming the Swiss Government for their loss then do not go into denial yourself. Respond appropriately.

Fill in a redemption request now and redeem your full investment. It is your money. Do not leave your money in the hands of the reckless and deluded.

John

Nice to see you upgrading to substack

Many of the classic Bronte Capital blog entries have made their way onto Substack. Big win for them.

Time to enjoy those 2000s posts about RBS and phototours of fraudulent Chinese factories again!